© 2025 Bridgement (Pty) Ltd.All Rights Reserved.

Community Scheme Funding

Access a lump sum amount for a fixed term to cover expansion or maintenance expenses, with Bridgement’s online Community Scheme Funding.

- Apply in 2 minutes

- Approvals within 24-hours

- Free to apply

See why business owners choose us

Apply nowLightning fast

Apply online in 2 minutes, get funds in your account within hours. No paperwork means you’ll get on with your business in no time.

Unmatched flexibility

Settle early when it suits you and get rewarded with a discount. No prepayment penalties and no cancellation fees.

Full transparency

Always know the exact cost and only pay for what you use. No hidden fees or application charges. No surprises.

Maximum control

You decide how much to draw and when. Access your Bridgement online dashboard 24/7 and request funds instantly.

How to get Community Scheme funding from Bridgement

01. Get approved online

Submit an online business loan application and get approved within 24 hours. Once approved, manage your business loan facility from your Bridgement dashboard.

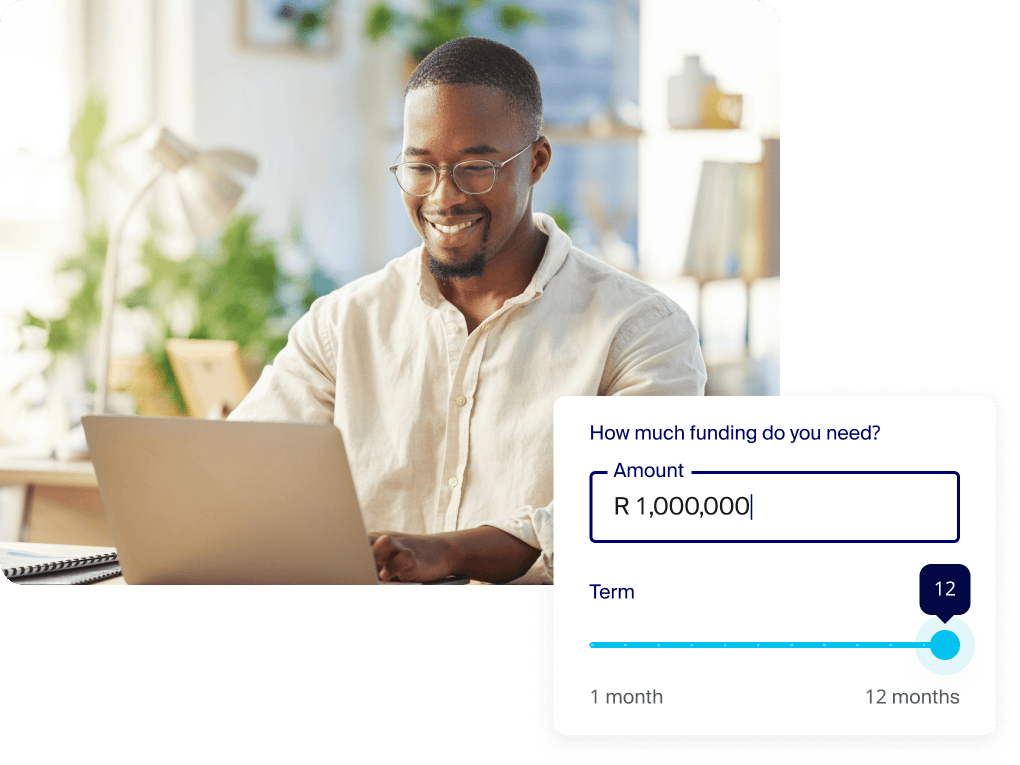

02. Withdraw funds

Choose an amount up to your credit limit, select your repayment terms, and accept the quoted finance cost. The funds will be sent to your bank account immediately.

03. Repay over 1 to 12 months

Pay us back over the agreed term or prepay at any stage and get rewarded with a discount to save on your finance costs.

Awards and recognitions

Xero

Xero South African App of the Year 2023

Wealth & Finance

Most Innovative Business Lender 2023

GFM Review

Best Fintech Award 2023

Xero

App of the Year Award Finalist 2022 / 2023 / 2024

SA Small Business Awards

National Funding Award 2020

A new way to fund your community scheme

Online, Instant & paperless

Apply in minutes, get funds in hours.

One simple transparent fee

Easy to understand pricing without complex fee structures.

Flexible

Get approved once, repay and re-use your loan facility many times over.

Early settlement discounts

Save on the remianing fees when settling early.

Don’t let late paying levies or expensive short-term projects stop you from sticking to your plans. Access Bridgement’s Community Scheme Funding and get your project finished!

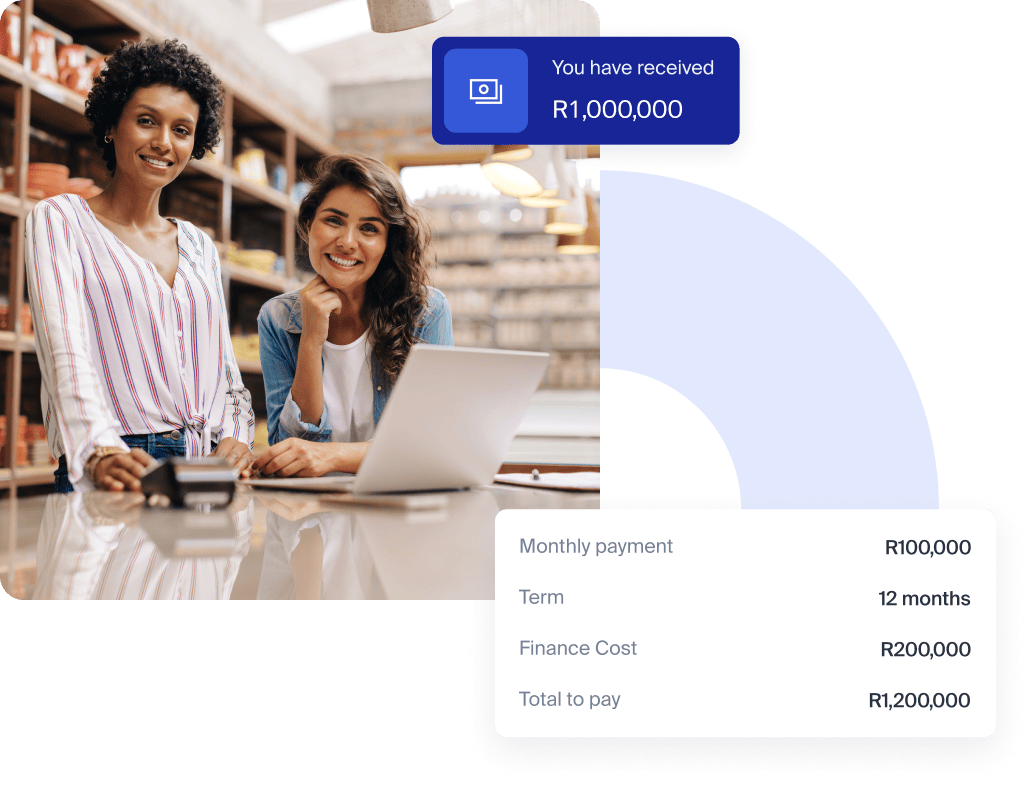

Simple and transparent pricing

- Fixed cost

- Prepayment discounts

- No hidden costs

Min R20,000 – Max R5,000,000

*This example is indicative only. Apply now to get your personalised pricing and terms.

Keep in mind: A single fixed finance cost is charged per withdrawal and you’ll always know the cost before agreeing to anything. The finance cost quoted is your total cost and there are no additional interest, account fees or application charges.

Community Scheme FAQ’s

Here are some frequently asked questions or you can view more FAQs.

We service all types of registered community schemes including home owners or property scheme associations, complexes, estates, share block or sectional title schemes, retirement estates and housing co-operatives.

Bridgement charges a single, simple fee per withdrawal. This single fee is the total cost of finance and there are no other hidden costs involved. There are also no hidden costs such as fees to apply or ongoing monthly facility fees. Our pricing is completely transparent and quoted upfront – you will always know the exact cost of funding when using Bridgement. The rate you’re charged will depend on a number of risk based factors including the age of the community scheme, current financial situation and levy collection history. You’ll also qualify for a better rate the more you use your Bridgement facility and once you’ve built up a track record. View our pricing calculator to get a sense of what your rate could look like.

Bridgement offers South African community schemes a convenient, fast and flexible way to obtain funding. Whether that’s to mitigate late levy collections, to complete maintenance projects, install solar and various other capital intensive projects. The online application process for a Bridgement credit facility is quick, simple and headache-free.

Banks offer a number of financing options including business loans, overdrafts and asset finance. Unfortunately, banks often need lots of documentation and can take months to process your application, which more often than not ends up being declined. Bridgement offers community schemes credit facilities up to R5,000,000; through an online application process that can be completed within 2 minutes, with feedback on your application typically given within 24 hours.

If you are a Managing Agent in South Africa and would like to sign up to become a certified referral partner, click here to sign up. The partnership would strengthen your value-add to your clients but also provide an additional revenue stream for your business. We pay referral fees in perpetuity to our partners for introducing their clients to Bridgement.

There must be a minimum value of R1,000,000 in annual levies or common assets. You will need to show an established levy collections history of at least 6 months.