© 2025 Bridgement (Pty) Ltd.All Rights Reserved.

Business loans

Access a lump sum amount for a fixed term to cover a business expense, with Bridgement’s online business loans.

- Apply in 2 minutes

- No paperwork

- No hidden costs

See why business owners choose us

Apply nowLightning fast

Apply online in 2 minutes, get funds in your account within hours. No paperwork means you’ll get on with your business in no time.

Unmatched flexibility

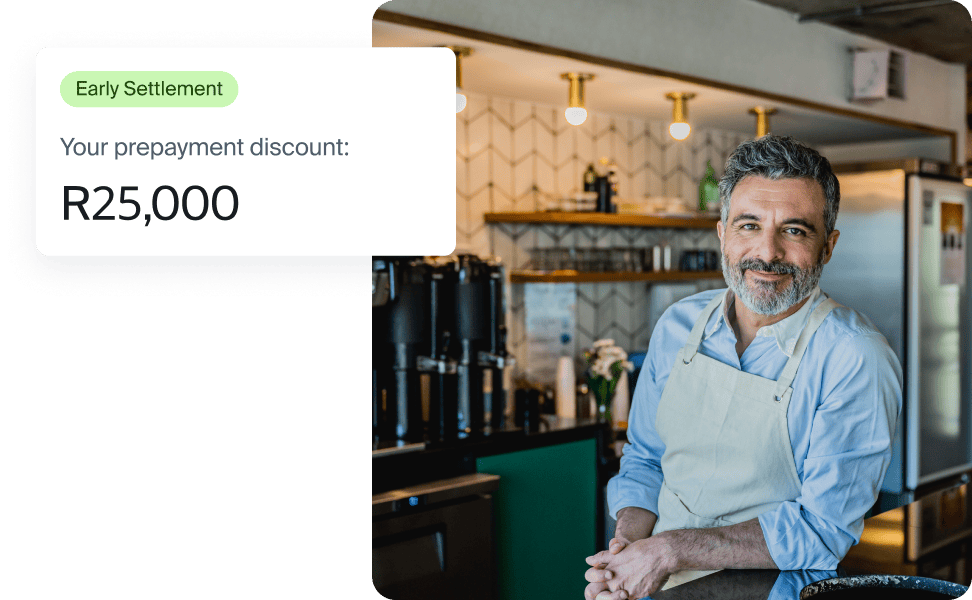

Settle early when it suits you and get rewarded with a discount. No prepayment penalties and no cancellation fees.

Full transparency

Always know the exact cost and only pay for what you use. No hidden fees or application charges. No surprises.

Maximum control

You decide how much to draw and when. Access your Bridgement online dashboard 24/7 and request funds instantly.

How a Bridgement business loan works

01. Get approved online

Submit an online business loan application and get approved within 24 hours. Once approved, manage your business loan facility from your Bridgement dashboard.

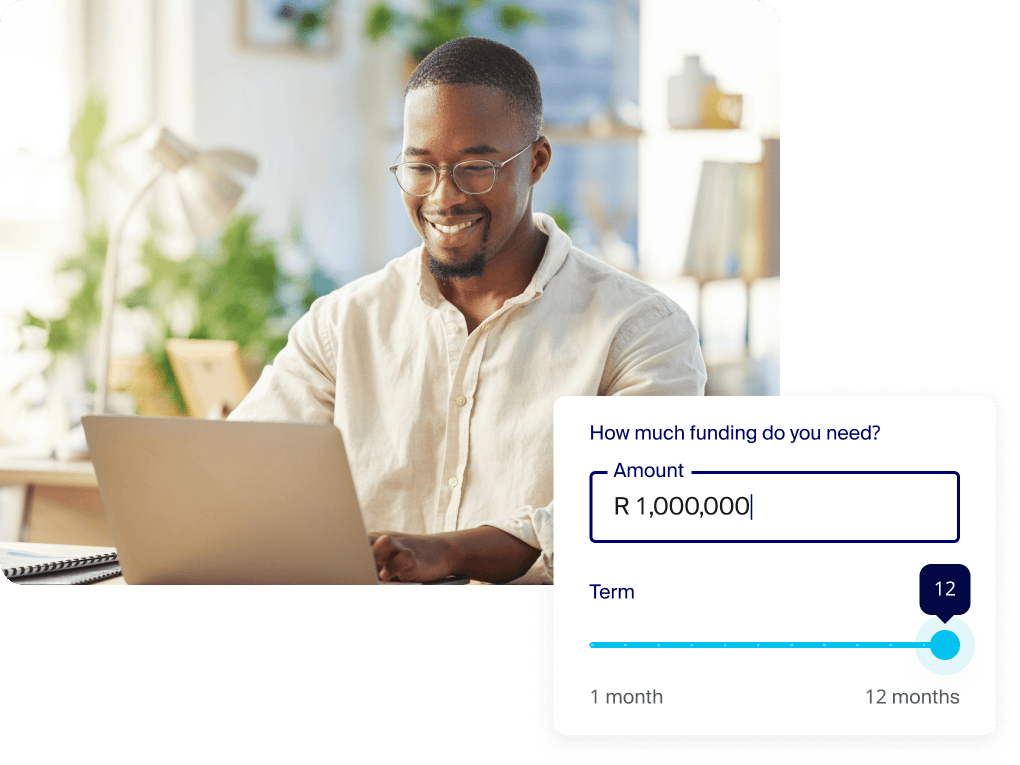

02. Withdraw funds

Choose an amount up to your credit limit, select your repayment terms, and accept the quoted finance cost. The funds will be sent to your bank account immediately.

03. Repay over 1 to 12 months

Pay us back over the agreed term or prepay at any stage and get rewarded with a discount to save on your finance costs.

Awards and recognitions

Xero

Xero South African App of the Year 2023

MEA Markets

Most Innovative Business Funding Provider SA 2024

Wealth & Finance

Most Innovative Business Lender 2023

GFM Review

Best Fintech Award 2023

Xero

App of the Year Award Finalist 2022 / 2023 / 2024

Join the businesses that we have supported thus far

A business loan that works for you

Online, instant & paperless

Apply in minutes, get funds in hours. No lengthy forms or paperwork.

One simple transparent fee

Easy-to-understand pricing without complex fee structures. No facility/monthly fees.

Flexible

Get approved once, repay and re-use your business loan facility many times over.

Prepayment discounts

Save on the outstanding finance cost when settling your business loan early.

Don’t be discouraged by the complex application process at your bank or other credit providers. Submit an online application and get approved today for a Bridgement business loan facility – no fee to apply and no commitment to use the funds.

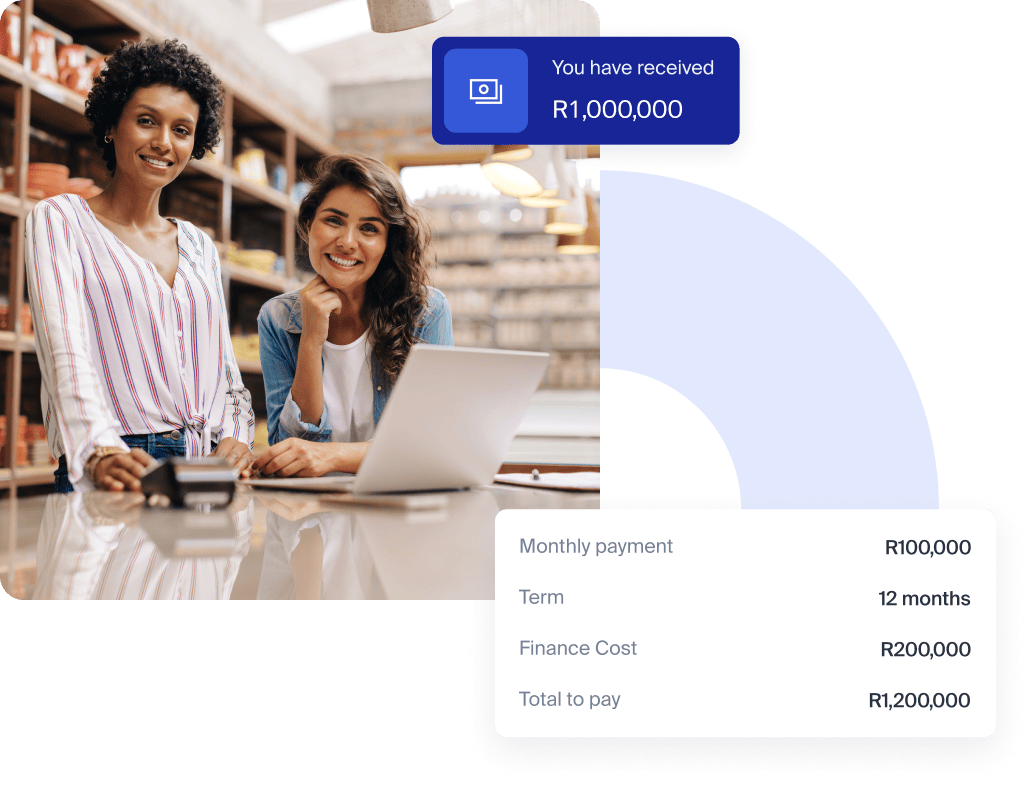

Simple and transparent pricing

- Fixed cost

- Prepayment discounts

- No hidden costs

Min R20,000 – Max R5,000,000

*This example is indicative only. Apply now to get your personalised pricing and terms.

Keep in mind: A single fixed finance cost is charged per withdrawal and you’ll always know the cost before agreeing to anything. The finance cost quoted is your total cost and there are no additional interest, account fees or application charges.

New to online business loans?

Here are some frequently asked questions or you can view more FAQs.

A small business loan is the funding a small business needs to run or grow their business. The loan is provided in the form of working capital which is then used by the small business to finance their needs, pay for unexpected costs or to expand their business. Many South African businesses run into cash flow problems and struggle to get a flexible business loan quickly and easily. Luckily Bridgement is here to close the gap.

Bridgement charges a single, simple fee per business loan withdrawn. This single fee is the total cost of finance and there are no other fees or interest charged. There are also no fees to apply and no ongoing monthly facility fees. Our pricing is completely transparent and upfront – you will always know the exact cost for each business loan you take from Bridgement. The pricing you’re charged will depend on a number of factors including your business situation, credit score and trading history. You’ll also qualify for better pricing the more you use your Bridgement facility and once you’ve built up a track record. View our pricing calculator to get a sense of what your rate could look like.

If you don’t have a long credit history or substantial assets to offer as collateral, you’ll find it challenging to apply for traditional business loans. Furthermore, traditional financing can take months to be approved. A Bridgement business loan facility offers business owners a convenient, fast and flexible way to obtain funding needed to grow. Whether that’s for buying raw materials or stock; buying an expensive piece of equipment/machinery; or even funding a short term gap in cash flow. The online application process for Bridgement facility is quick, simple and headache-free.

An online business lender provides fast business loans through a simple online process. This new way of getting a business loan provides the fastest turnaround times and removes the need for long forms and paperwork. Completing a business loan application takes two minutes on Bridgement’s website and you’ll normally get a loan decision within 24 hours. Bridgement is completely online and won’t need to meet you in person. You also won’t have to provide any financial projections or business plans. Once approved for an online business loan facility, you’ll get access to a dashboard on Bridgement’s website where you can manage and withdraw funds from your business loan facility. Funds will usually land in your bank account within an hour of making the loan request on your dashboard.

Business owners facing cash flow issues need funding fast. Banks offer a number of financing options including business loans, overdrafts and asset finance. Unfortunately, banks often need a lot of documentation and take over three months to process your application before supplying you with funds. Other funding options like venture capitalists and angel investors also have rigorous, paper-based application processes that take even longer than the banks. Taking funding from them also results in dilution of your ownership of your business. Bridgement offers business loans and credit facilities in just 24 hours, and its automated online application means you can apply in just minutes, without having to submit any paperwork.

You can apply for a business loan through a bank. Be ready to provide a full business plan, financial projections, and financial records. Applications can take weeks to complete and months to process. Banks typically won’t approve you if you’re within your first 2-3 years of trading, or if you don’t have an existing track record with them. You can also apply for funding through an investor. Finding a willing investor is hard and you will probably have to exchange equity in your business for funding. This means your ownership of the business gets diluted and you’ll have to get agreement from multiple partners before making key business decisions. The South African government offers a number of grants and loans, but you will need to fit specific criteria to qualify. Bridgement offers an exciting alternative with the first online business loan facility, a quick and easy way to get business loans online.